Rand slips as the reality of SA's debt trajectory sets in

News24

26 Feb 2021, 23:43 GMT+10

- The rand was the worst performing emerging market currency on Thursday, it weakened beyond R15/$ in the overnight session.

- The local currency had previously made gains on a global market risk-on sentiment and higher commodity prices.

- Foreign investors are differentiating SA from the other emerging markets, as its government bonds are deemed highly risky, says an economist.

The rand broke below the R15/$ mark overnight - essentially losing gains made in February; this amid a surge in US bond yields which is adding pressure to emerging market currencies.

The rand was the worst performing emerging market currency on Thursday - which came as a shock as it had previously made gains on the back of market risk-on sentiment and higher commodity prices.

Shortly after the tabling of the budget on Wednesday, it strengthened slightly to below R14.50/$ and even reached a 14-month high of R14.38/$ during the day's trading session, according to Bianca Botes, executive director at Citadel Global.

But Thursday brought new surprises. "It tested the R14.80/$ level during the afternoon but soon broke past the R15.00 mark in the overnight session as a spike in US bond yields added pressure to the rand," Botes commented in a market update issued on Friday.

The local unit started the day at R15/$, by mid-morning it had strengthened 1.50% to R14.83 to the greenback.

In addition to the 1.60% spike in US treasury yields (the highest in a year), the US dollar also started clawing back losses from the past few days further impacting emerging markets, Andre Cilliers, currency strategist at TreasuryONE noted.

"The fallout from the US Treasury Yields also resulted in the commodity market selling off with all commodities starting the day in the red," he added. Most commodities were still trading lower by mid-morning, with gold at $1 767, platinum at $1 215 and brent crude at $66 per barrel.

Further ashore, US markets and Asian markets had also been struggling, Cilliers pointed out. "It is evident that the market is currently 'risk-off', and should this push through to the currency space, we could see EM's on the back foot during today's trading," said Cilliers. On the bright side, exporters could benefit, he added.

In a separate note, Investec chief economist Annabel Bishop commented that the strength the rand had displayed following the tabling of the budget had soon faded, this as markets ""digested" the implications of the country's debt.

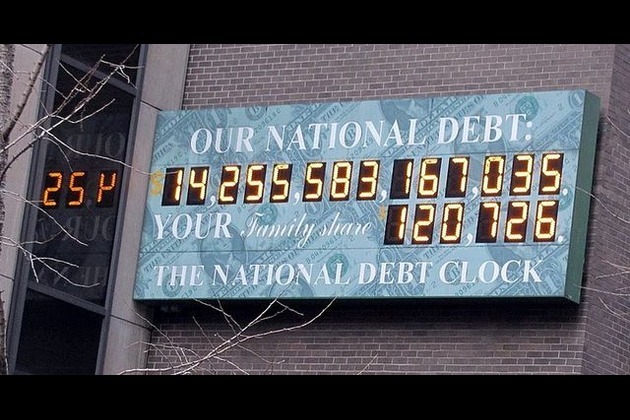

According to the budget review, the budget deficit for the 2020/21 fiscal year will reach a record 14% of GDP, it is only expected to narrow to 6.3% by 2023/24. Currently debt servicing costs account for 13.4% of the budget or nearly R270 billion. Over the medium term it is expected to avrage 20% of gross tax revenue- this means for every R5 gained in tax revenue, R1 goes toward servicing debt. According to a presentation by Treasury to Parliament on Thursday, debt is projected to grow by 7% of GDP over the next three years.

"Indeed, the rand could weaken somewhat further as the initial exuberance is reversed further on the realisation that the debt trajectory planned now, while lower than October's, is still in excess of that expected a year ago, and well in excess of other EM middle income economies," said Bishop.

Even though the rand was bolstered by commodity prices - foreign investors are starting to differentiate South Africa from other emerging markets - especially as its government bonds are considered "highly risky", she added.

Bishop also noted that investors are in risk-off mode which is contributing to rand weakness.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Colorado Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Colorado Star.

More InformationInternational Business

SectionShein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

Australian PM rejects US pressure to ease biosecurity rules

SYDNEY, Australia: Australia will not ease its strict biosecurity rules during trade talks with the United States, Prime Minister Anthony...

Haryana to develop Asia's largest jungle safari in Aravalli Hills

New Delhi [India], July 6 (ANI): A grand jungle safari project coming up in the Aravalli Hills is going to redefine Haryana's identity....

"Every flight feels heavier now....": Raashii Khanna says she finds it hard to travel after Air India tragedy

Mumbai (Maharashtra) [India], July 6 (ANI): The tragic Air India crash in Ahmedabad last month has left many shaken, including actor...

US

SectionMoscow removes Taliban from banned list, grants official status

MOSCOW, Russia: This week, Russia became the first country to officially recognize the Taliban as the government of Afghanistan since...

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Netanyahu vows 'No Hamas' in postwar Gaza amid peace talks

CAIRO, Egypt: This week, both Hamas and Israel shared their views ahead of expected peace talks about a new U.S.-backed ceasefire plan....

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

US sends message by publicizing visa ban on UK punk-rap band

WASHINGTON, D.C.: The Trump administration has made public a visa decision that would usually be kept private. It did this to send...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...