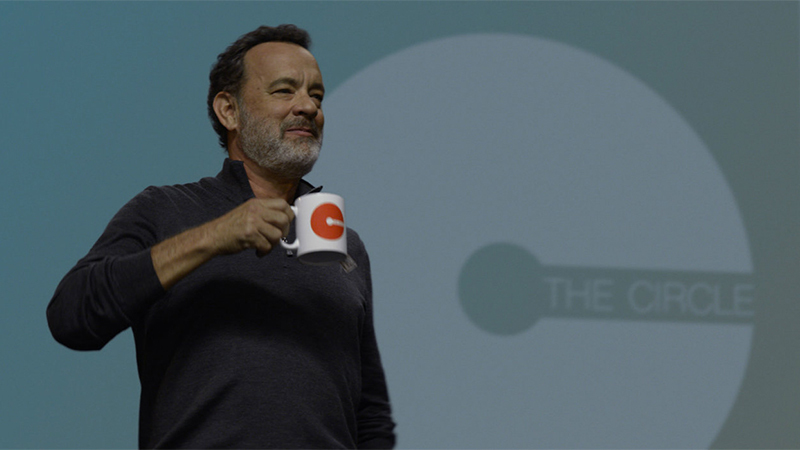

Bulgaria's Eurozone Entry: Facts That Bust the Biggest Myths

Novinite.com

29 Jun 2025, 15:39 GMT+10

With Bulgaria's accession to the eurozone now officially scheduled for January 1, 2026, following unanimous approvals by both the Eurogroup on June 19 and ECOFIN on June 20, disinformation and conspiracy theories about the euro are once again spreading. From price spikes and foreign debt to sovereignty loss and surveillance through the digital euro, here is what's being claimed - and what the facts really are.

Will prices skyrocket after the euro is introduced?

The most widespread fear concerns inflation. According to economist Prof. Viktor Yotsov, people often conflate inflation with high prices. Inflation refers to a general and ongoing rise in prices. But prices may already be high for other reasons, and that alone doesn't equal inflation. The adoption of the euro is not inherently inflationary. If someone has the market power and intent to raise prices, they are likely doing so already - regardless of the currency in use.

Prime Minister Rosen Zhelyazkov and the head of the National Revenue Agency, Rumen Spetsov, both underlined in May and June that current price increases are not driven by eurozone accession. Traders may try to exploit the transition period, but the government is actively working to prevent speculative price hikes.

Prof. Yotsov also noted that Bulgaria, like other former socialist countries, still has significantly lower average prices than the rest of the EU - around 60?70% of the EU average. As price levels gradually converge, Bulgaria is likely to experience higher inflation than wealthier member states, but this trend is independent of whether the country adopts the euro or not.

Will exchanging leva for euros be complicated?

Authorities have prepared extensively for the transition. Bulgarian National Bank (BNB) Governor Dimitar Radev stated in May that the country is fully ready. Once the euro is adopted, there will be a one-month window during which both leva and euros can be used for cash payments. During this period, receipts will show totals in both currencies, and retailers will be obligated to return change in euros where possible.

For six months, banks will offer free and unlimited conversion of leva to euros at the fixed rate. For sums over BGN 30,000, a three-day advance notice will be required. Large retailers will have euro cash on hand, and post offices across the country - more than 2,000 locations - will offer currency exchange services, particularly in smaller towns.

Professor Yotsov emphasized that there will be multiple ways for citizens to exchange their money and assured that the entire process will be smooth and without fees. He expects no confusion or financial disruption.

Will salaries, pensions, and deposits be affected?

All existing financial instruments - wages, pensions, loans, deposits - will be automatically recalculated into euros using the official fixed exchange rate. This process requires no action from citizens and comes with safeguards against abuse. Interior Minister Daniel Mitov confirmed that law enforcement is monitoring online forums and social media to identify potential fraud, counterfeiting, and fake news related to the transition.

Is Bulgaria giving up its sovereignty by joining the eurozone?

While concerns about the loss of monetary independence are common, Prof. Yotsov explained that Bulgaria has not had an autonomous monetary policy since 1997. That year, the Currency Board was introduced, effectively outsourcing monetary control by fixing the lev to the German mark, and later to the euro.

Under the Currency Board, the central bank cannot issue new money, conduct open-market operations, or refinance commercial banks. These are the traditional tools of monetary policy, and Bulgaria has not had access to them for nearly three decades. Joining the eurozone does not represent a further surrender of sovereignty - it is the formalization of a situation that already exists.

Will the European Central Bank control Bulgaria's foreign reserves?

This claim is false. Even within the Eurosystem, each central bank - including the BNB - manages its own reserves. Only a small portion of the reserves will become part of the joint pool managed by the European Central Bank. The BNB will retain control over its assets.

Yotsov clarified that a large share of the BNB's current reserves consists of mandatory deposits from commercial banks. Under current Bulgarian regulations, banks must keep 12% of deposits at the central bank - far higher than the 1% required by the ECB. When Bulgaria joins the eurozone, this requirement will fall, releasing significant liquidity. However, this money belongs to the commercial banks, not the BNB. Some of it may remain in the system as excess reserves; some may be repatriated by the parent companies of foreign-owned banks. Either way, it will not automatically lead to inflation.

Will Bulgaria be responsible for the debts of other eurozone countries?

No. This myth has been circulating since Bulgaria joined the ERM II mechanism in 2020. The truth is that no eurozone or EU member state is liable for another country's national debt. The relevant EU treaties explicitly rule out such arrangements.

According to Prof. Yotsov and other experts, such financial commitments can only arise from bilateral agreements between countries - never through automatic mechanisms of the eurozone. Associate Professor Grigoriy Vazov also described the idea that Bulgaria would take on the debt of others as "absurd."

Will the digital euro be used to control people?

This narrative has become increasingly common but remains entirely unfounded. The digital euro, currently in a preparatory phase until at least October 2025, is designed with privacy as a core feature. According to both the European Central Bank and fact-checking reports from Euronet Plus, the digital euro will allow for secure payments without revealing user data to third parties - aside from minimal data needed to prevent illegal activities.

The ECB has no interest in commercializing personal payment data and will not share it with institutions like national finance ministries. The aim is to provide a digital payment tool that guarantees privacy and complements existing options - not to create a system of control.

Takeaway

The myths surrounding Bulgaria's adoption of the euro - from fears of mass inflation to fantasies of lost sovereignty or surveillance - lack any factual basis. As the country moves toward its January 2026 entry into the eurozone, the focus remains on transparency, institutional preparedness, and protecting consumers from speculative behavior.

Sources:

Bulgarian National Radio (BNR)

- Club Z media

National Revenue Agency (NRA)

- Bulgarian News Agency (BTA)

Ministry of Interior

European Central Bank (ECB)

European Union news network Euronet Plus

Eurostat

Expert opinion ? Associate Professor Dr. Grigoriy Vazov on eurozone debt responsibilities

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Colorado Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Colorado Star.

More InformationInternational Business

SectionTrump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

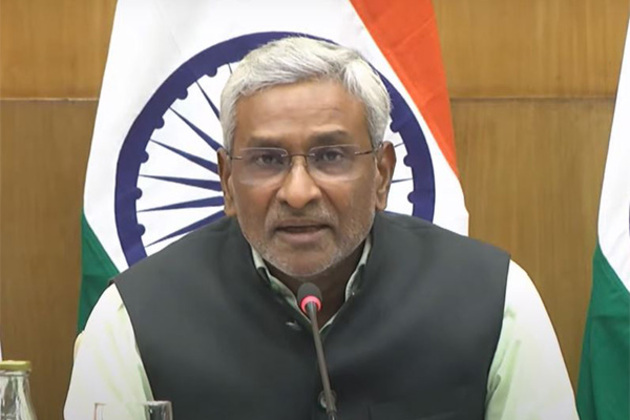

PM Modi's 5-nation visit: Vaccine development among focus items in Ghana; discussions in Namibia to touch on UPI expansion

New Delhi [India], June 30 (ANI): Prime Minister Narendra Modi's upcoming five-nation tour, beginning on July 2, will see significant...

India to set up vaccine hub in Ghana, expand UPI in Namibia during PM Modi's multi-nation tour

New Delhi [India], June 30 (ANI): Prime Minister Narendra Modi's upcoming five-nation tour, beginning on July 2, will see significant...

Cash disappearing in China Le Monde

Mobile payments are dominant in the Asian country, while the traditional means of exchange has dwindled to near extinction, the outlet...

Pakistan government increases gas prices

Islamabad [Pakistan], June 30 (ANI): Pakistan's Oil and Gas Regulatory Authority (OGRA) announced a gas price hike for the majority...

At least 9,800 millionaires are expected to relocate to UAE in 2025

New Delhi [India], June 30 (ANI): The United Arab Emirates continues to solidify its reputation as a premier destination for the world's...

US

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....