Daily volume in money market surged by 10% YoY to Rs 5.5 lakh crore in FY25: RBI

ANI

29 May 2025, 14:42 GMT+10

Mumbai (Maharashtra) [India], May 29 (ANI): The Reserve Bank of India (RBI) has reported a sharp rise in money market activity and sustained momentum in bank credit growth during the financial year 2024-25.

According to the central bank's latest report, the average daily volume in the money market rose by 10 per cent to Rs 5.5 lakh crore during 2024-25 compared to the previous year.

The report noted that both bank deposits and credit continued to grow at a double-digit pace during the year. Although deposit growth lagged behind credit growth, however the gap narrowed over the course of the year.

Notably, public sector banks (PSBs) recorded higher credit growth than private sector banks, highlighting their active lending approach.

According to the report, bank credit expansion was broad-based, with strong contributions from the retail, services, and agriculture sectors.

The central bank stated that credit to agriculture and allied activities maintained double-digit growth throughout the year. Industrial credit remained robust, supported by a pick-up in lending to medium and large industries.

However, credit to micro and small industries showed some moderation in recent months.In terms of interest rates, the report said money market rates remained broadly aligned with the policy repo rate throughout 2024-25. Meanwhile, government securities (G-sec) yields softened and showed less volatility compared to global and emerging market counterparts.

The Indian rupee (INR) witnessed a depreciating trend in the second half of the year due to a stronger US dollar and equity portfolio outflows.

The report also provided a detailed quarterly analysis of Government Securities yield movements. The first quarter (Q1:2024-25) saw G-sec yields move both ways. Yields initially rose due to foreign portfolio investment (FPI) outflows and rising crude oil prices. However, they softened later following the RBI's record surplus transfer to the government.

The second quarter (Q2:2024-25) witnessed a steeper yield curve, with short-term G-sec yields falling more than long-term ones. This was driven by declining crude oil prices, steady FPI inflows, and the start of a global rate-cutting cycle, including a 50-basis point cut by the US Federal Reserve.

The third quarter saw range-bound movements in G-sec yields. Upward pressure from rising US Treasury yields and domestic inflation was partially offset. Q4:2024-25 experienced a downward trend in yields due to liquidity infusion measures and the RBI's move to ease monetary policy.

By the end of the financial year, the 10-year generic G-sec yield stood at 7.01 per cent, marking a 5 basis point decline from its level at the end of March 2024. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Colorado Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Colorado Star.

More InformationInternational Business

SectionDaily volume in money market surged by 10% YoY to Rs 5.5 lakh crore in FY25: RBI

Mumbai (Maharashtra) [India], May 29 (ANI): The Reserve Bank of India (RBI) has reported a sharp rise in money market activity and...

"Sikkim's biggest reason for transformation is connectivity improvement": PM Modi highlights rail-road infra development in region

Bagdogra (West Bengal) [India], May 29 (ANI): Prime Minister Narendra Modi on Thursday said improving connectivity remains one of the...

RBI will continue liquidity management operations in sync with monetary policy stance: Annual Report

New Delhi [India], May 29 (ANI): The Reserve Bank of India (RBI) will continue to undertake liquidity management operations to ensure...

Indian economy outlook promising in 2025-26, supported by fiscal discipline and growing demand: RBI

New Delhi [India], May 29 (ANI): The Indian economy is expected to remain promising in 2025-26, supported by a range of positive indicators,...

India set to be primary engine of growth in 2025 and 2026: World Economic Forum

New Delhi [India], May 29 (ANI): India is expected to be the primary engine of global economic growth in 2025 and 2026, according to...

SLOVENIA-LJUBLJANA-CONFUCIUS INSTITUTE-15TH ANNIVERSARY

(250528) -- LJUBLJANA, May 28, 2025 (Xinhua) -- Members of the Chinese Yangqin Art Troupe perform during the 15th anniversary celebration...

US

SectionQuits job, sails ocean: Oliver Widger reaches Hawaii with cat Phoenix

HONOLULU, Hawaii: A man from Oregon, Oliver Widger, has arrived in Hawaii after sailing across the ocean with his cat, Phoenix. He...

Amid trade tensions, France, Vietnam ink deals worth $10 billion

HANOI, Vietnam: Amid shifting global trade dynamics and growing concerns over U.S. tariffs, France and Vietnam have signed more than...

China’s GAC launches in Brazil as EV demand accelerates

SAO PAULO, Brazil: Amid a surge in electric vehicle (EV) adoption and growing competition in Brazil, Chinese automaker GAC has officially...

Historic vote for judges in Mexico marred by criminal ties

CIUDAD JUAREZ, Mexico: In a first-of-its-kind judicial election in Mexico, more than 5,000 candidates are vying for over 840 federal...

McDonald’s to shut down CosMc’s drink spinoff after short run

CHICAGO, Illinois: McDonald's is closing its experimental beverage spinoff, CosMc's, less than two years after launching the standalone...

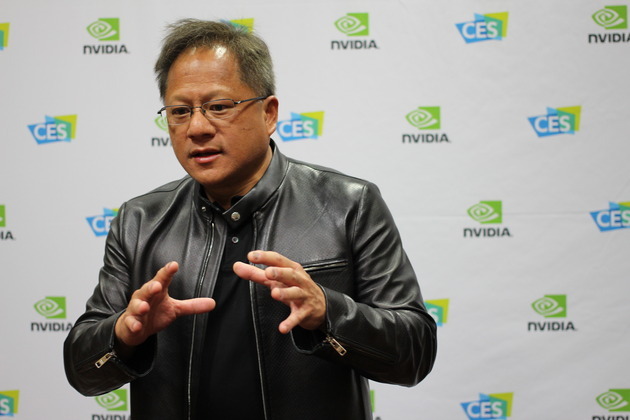

Nvidia targets China’s data market with new AI chip

BEIJING/TAIPEI: Facing mounting U.S. export restrictions, Nvidia is preparing to launch a new, lower-cost artificial intelligence chip...